Gartner Magic Quadrant, Nucleus Value Matrix & other ECM stuff

Im Spät-Herbst kommen meistens die zahlreichen Reports der Analysten heraus. So auch wieder die Gartner Magic Quadrants für WCM, ECM und anderes oder die Nucleus Value Matrix for ECM. Hier zum Start nur die Grafiken - die Besprechung der Reports folgt später.

Ja, wir wissen, man soll nicht allein die Grafiken veröffentlichen, weil die Kriterien, die Hintergründe der Einschätzung, die Restriktionen und andere wichtige Einzelheiten aus der Grafik allein nicht ablesbar sind. Ach ja, und einige der kartierten Anbieter sind auch schon nicht mehr eigenständig am Markt: bei ECM übernimmt OpenText nun Documentum und bei WCM wurde Hippo gerade von BloomResearch übernommen.

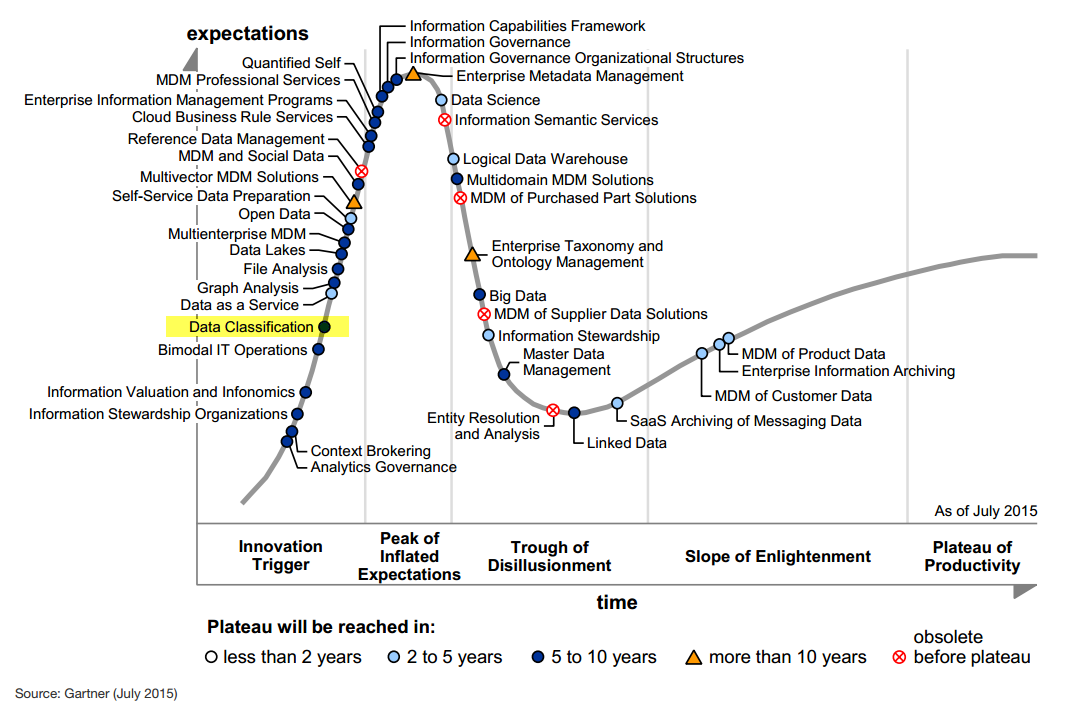

Von Gartner gibt es auch einen Hype Cycle für EIM Enterprise Information Management (wann werden denn endlich ECM und EIM zusammengeführt?) - die 59 Seiten kosten allerdings fast 2000 $US (deshalb gibt es hier nur die Grafik des EIM Hype Cycle von 2015).

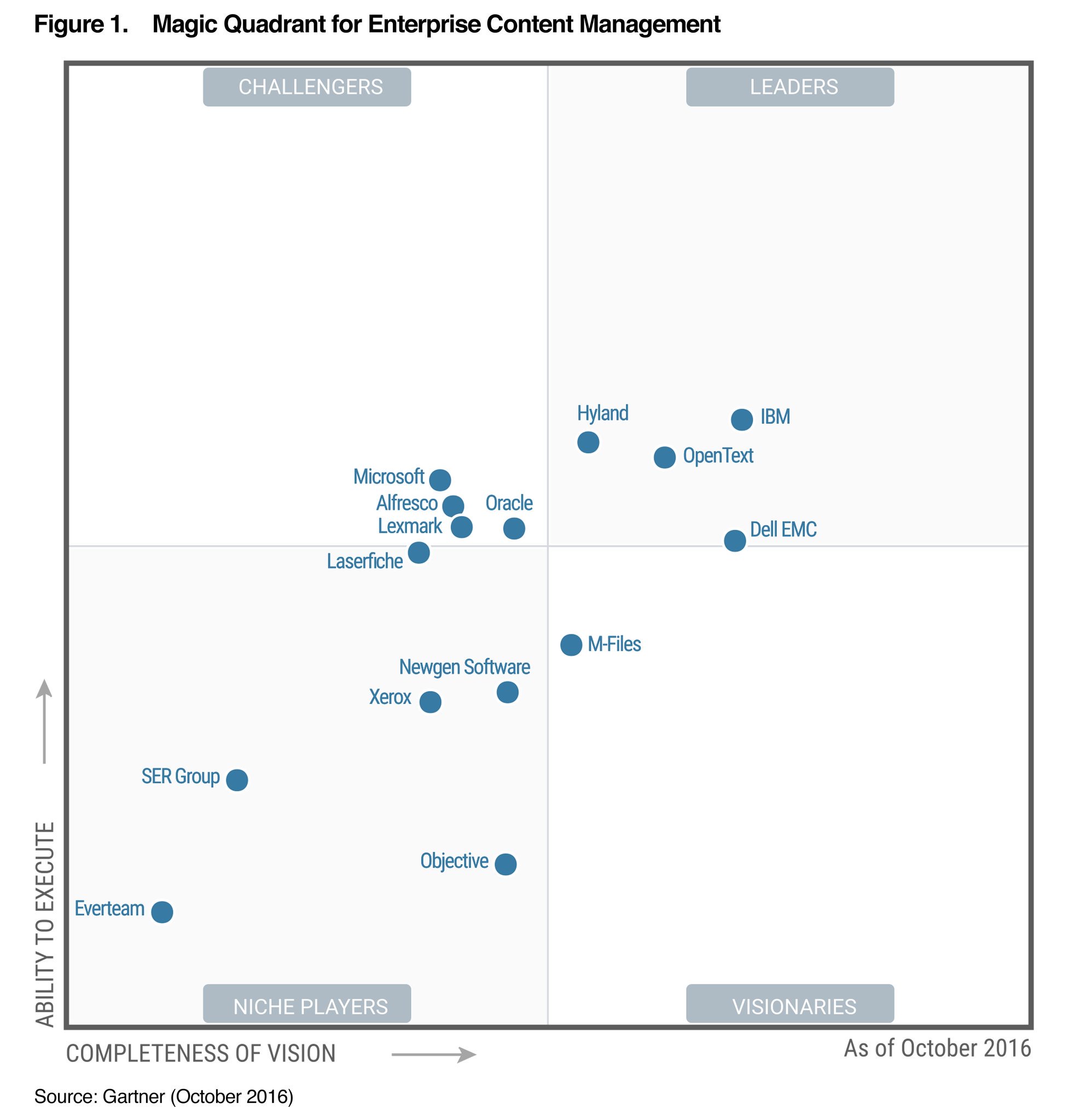

Gartner Magic Quadrant Enterprise Content Management 2016

Positiv am Report ist, dass es auch wieder eine separate Bewertung für die Situation in Europa gibt. DIe Kriterien, was nun ECM Enterprise Content Management ausmacht, wurden auch überarbeitet - und einige Bereiche fehlen weiterhin, da sie anderen Quadranten zugeordnet sind.

Gartner Magic Quadrant Web Content Management 2016

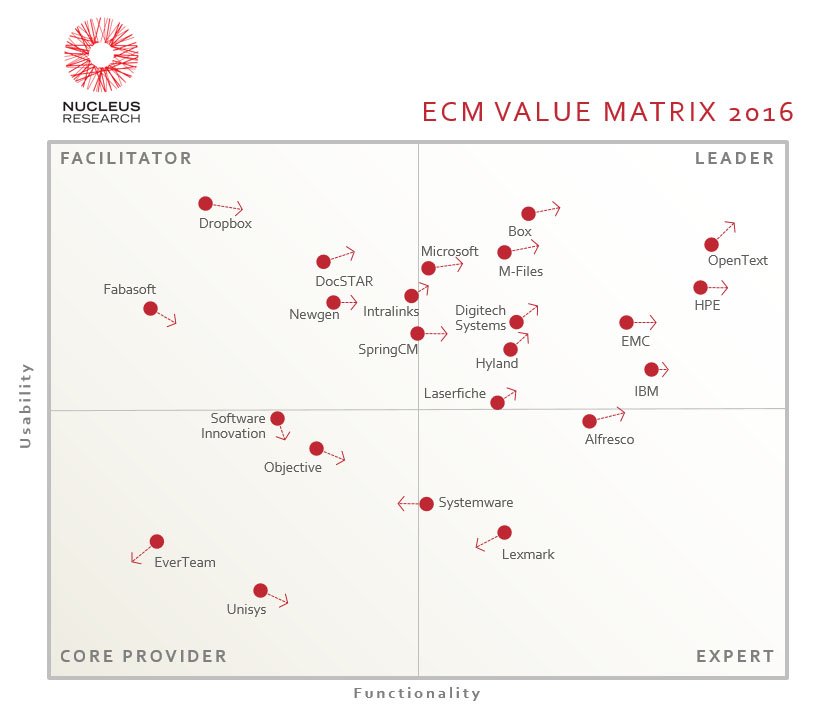

Nucleus Value Matrix ECM 2016

Gartner Hype Cycle Enterprise Information Management 2015

Zuletzt aktualisiert am 02.11.2016. Autorenrechte.

Persistente URL: http://www.pc.qumram-demo.ch/ecm/news/2016/gartner_magic_quadrants_2016_ecm_wcm_etc

Kommentare

Gartner MQ ECM 2016 revisited

Den Gartner Magic Quadrant Enterprise Content Management 2016 hatten wir oben ja schon verlinkt http://bit.ly/2g5z008, aber da man ja die Quadranten-Grafik nicht ohne Erklärung verwenden soll - sie ist letztlich nur eine mögliche Darstellung aus der dahinterliegenden Datenbank - hier noch ein paar Anmerkungen und Auszüge aus dem Report.

Annahmen für die strategische Planung

Beschreibung des Marktes und Definition von Enterprise Content Management

Hier ist zunächst - wie immer - festzustellen, dass sich Gartner nicht an der allgemein gültigen Definition der AIIM international orientiert. Dies liegt auch daran, dass bestimmte Komponenten in die "Zuständigkeit" anderer Analysten bei Gartner fallen - so z.B. BPM Business Process Management, EIM ENterprise Information Management oder Archiving. So gesehen zeigt der Magic Quadrant füer Enterprise Content Management nur einen Ausschnitt der relevanten Funktionalität von ECM (siehe Wikipedia ECMS). Gartner definiert den Markt wie folgt und ändert dabei auch mal gleich wieder schnell den Fokus und die Definition:

"Gartner has traditionally used the term "enterprise content management" (ECM) to describe products with a range of capabilities for managing unstructured enterprise content. Although we still apply this term to such products, new technologies, external market challengers and digital business requirements are changing organizations' requirements for managing digital content. These changes are part of a functional evolution from a centralized, back-end, command-and-control focus on managing unstructured content to a more integrated approach that prioritizes content usability, processing and analysis. In response to these changes, Gartner has recast its definition of ECM to emphasize the strategic need for a more dynamic, flexible and adaptable approach to content within enterprises:

Die aktuelle Definition von ECM Enterprise Content Management basiert laut Gartner auf folgenden 8 Komponenten:

Document capture (scanning hardware and software, mobile device capture, optical and intelligent character recognition technologies and form-processing technology) performed either using native capabilities or through a formal partnership with a third-party solution provider.

The ability to store images of scanned documents as a native (nonrendered or converted) content type in a folder, and to route them through an electronic process. Extra credit is given for vertical or horizontal solutions, whether delivered directly or through partners.

Zum "Context" der Studie schreibt Gartner:

"Changes to ECM technologies and the ECM software market influence changes to organizations' business requirements. This Magic Quadrant reflects these changes by including:

These revisions — especially those to the inclusion and evaluation criteria — result in a new lineup and arrangement of vendors in this Magic Quadrant, which should not be compared directly with the lineup and arrangement of previous editions.

Recommendations

Application leaders in charge of ECM should:

Application leaders in charge of ECM should use this Magic Quadrant as just one tool to help them select an ECM software vendor and product. It should not be the sole influence on their decision. It is important that they devise selection criteria for their organization's particular functional and technical requirements. It is not wise, for example, to choose a Leader or to reject a Niche Player simply on the basis of either label. A vendor in any one of the four quadrants could be the best choice for particular needs."

Genug der Vorbemerkungen!

Magic Quadrant

Die Bewertungskriterien sind wie immer im Bericht gut erklärt. Nimmt man sich die einzelnen Sektoren des Quadranten vor, dann erhält man im Vergleich zum Vorjahr (http://bit.ly/ECMMQ2015) folgendes Bild:

Leaders

"Leaders have the highest combined scores for Ability to Execute and Completeness of Vision. They are doing well and are prepared for the future with a clearly articulated vision. In the context of ECM, they have strong channel partners, presence in multiple regions, consistent financial performance, broad platform support and good customer support. They are very strong in one or more technologies or vertical markets. They deliver a suite of technologies that addresses demand for direct delivery of most (if not all) of the eight essential functional components of ECM software, that is tightly integrated, and that is unique or best-of-breed in each area. Leaders demonstrate enterprise deployments; integration with other business applications and content repositories; incorporation of social, cloud and mobile capabilities; and vertical and horizontal solutions. Leaders drive market transformation."

Oben rechts ist es ziemlich leer geworden. Nur IBM und OpenText behaupten ihre Position. EMC darf sich etwas zu den Visionären absetzen, müsste aber eigentlich schon zu OpenText zugeschlagen werden. Nur von links rückt jetzt Onbase von Hyland in dieses Segment.

Challengers

"Challengers offer good functionality and have a substantial number of installations, but they lack the vision of Leaders. Nor do they, typically, possess all of the essential functional components of ECM software — or as many as the Leaders. Instead, they use partnerships to fill out their suites, or simply ignore some capabilities or markets altogether. Challengers may lack a broad ECM focus or wide geographical coverage, but they execute well, despite some product or market share limitations.

Oben links ist einiges gelandet, was früher sich bei den Leaders tummelte: Microsoft (endlich oben rechts raus), Oracle, Lexmark. Dazu noch Alfresco und Laserfiche.

Visionaries

"Visionaries may offer all eight of the essential functional components of ECM software natively. Alternatively, they may supply some of them through partnerships with other vendors. In some cases, Visionaries need to integrate acquisitions into their existing product portfolios. Visionaries typically show a strong understanding of the market and anticipate shifting market forces. They may lead efforts relating to standards, new technologies or alternative delivery models, but they have less Ability to Execute than Leaders."

Unten rechts im Quadranten ist M-Files gut gelandet. Passt zum neuen Ansatz der Software.

Niche Players

"Niche Players typically focus on specific categories of ECM technology (such as transactional content management technology), midmarket buyers, or supplements to the offerings of business application or "stack" providers. They may be vendors that are still ramping up their ECM efforts, or that have neither the Completeness of Vision nor the Ability to Execute to break out of the Niche Players quadrant. Some may be "boutiques" that serve only certain regions, industries or functional domains."

Warum der einzige deutsche Anbieter etwas abgerutscht ist, muss man wahrscheinlich in Detail-Daten gucken. Everteam und Objective können längst nicht mehr in der Oberklasse mitspielen. XEROX war schon mal besser positioniert. Aber Newgen aus Indien entwickelt sich gut und strebt in den Visionairies Quadranten.

Im Bericht finden sich zu jedem der Anbieter ausführlichere Beschreibungen, die auch die Einschränkungen beleuchten. Als weitere erwähnenswerte Anbieter werden Box und Docuware genannt (schön, ein weiteres deutschstämmiges Unternehmen)

Market Overview

The dynamics of the global ECM market are changing. As a practice, ECM is evolving into a strategic framework for services that target specific use cases and audiences. Meanwhile, the ECM technology market is becoming more purpose-driven, with the emergence of specialized technologies that can integrate tightly with affiliated content systems.

This evolution creates new opportunities and options for application leaders in charge of ECM, especially those engaged in digital business initiatives that:

Gartner has responded to these new dynamics by refining its definition of ECM to emphasize a more flexible approach and by stiffening the criteria that determine whether vendors qualify for inclusion in this Magic Quadrant. The changes to these criteria make it inadvisable to directly compare vendors' inclusion and positioning on this Magic Quadrant with 2015's Magic Quadrant.

The ECM market grew by 9.4% in 2015 to a worldwide revenue total of $5.9 billion in constant currency. That compares with a 2014 growth rate of 6.2% and a worldwide revenue total of $5.4 billion. The top-three vendors lost market share in 2015, while their smaller rivals gained. More notably, best-of-breed, local and multicountry vendors accounted for 33.8% of the market in 2015, up from 27.9% in 2013. For more details, see "Market Share Analysis: Enterprise Content Management, Worldwide, 2015."

Vendors are also responding to the new market dynamics. In 2015, several of the larger ones announced strategic plans and actions to recast their ECM approach, including buyouts, spinoffs and a willingness to sell off software assets. A restructuring of the market is therefore likely.

Buyers' interest in cloud-based models increased in 2015. Cloud offerings accounted for over 8% of the market's revenue, up from approximately 5% in 2014. These offerings vary widely in their completeness and geographic availability.

Another important trend is for EFSS vendors to add a range of content management capabilities to their existing offerings. These capabilities are often good enough for specific enterprise use cases. For additional information, see "From EFSS to ECM: Consider the Spectrum of Needs in Your Content Management Strategy."

Europe Context

Besonders interssant ist natürlich der Abschnitt mit den Informationen zum Markt in Europa (der dankenswerter Weise wieder sehr ausführlich geworden ist).

Market Differentiators

This report describes the key issues and requirements that clients should think carefully about when evaluating products and services related to enterprise content management (ECM). It also describes a number of vendors with specialist products and experience particularly suited to aspects of the European market.

Other key market differentiators are:

Recommendation:

Clients should ensure that the levels of localization are appropriate for their business needs and cover all aspects of the solution including the user interface, documentation, training and support services.

Recommendation:

Clients should ensure that vendors understand the specific regulations that apply to their country and sector, and that vendors can offer reference clients. Just because a vendor has a European headquarters does not automatically mean it has the necessary expertise.

Considerations for Technology and Service Selection

Recommendations:

Evaluate the vendor's capabilities to meet your specific business use cases and the specific regulatory requirements for your geographies.

Strategize and forecast the content services you are likely to need in the future to support planned business growth, expansion into new markets and new types of content for digital business initiatives.

Recommendation:

Require vendors and implementation partners to demonstrate their capacity, scope and manner of offering regionalized product and customer support, the local languages spoken by support staff, and their effectiveness in face-to-face engagement.

Recommendation:

Examine a vendor's financial viability, growth trends, track record of winning new business and visibility in the relevant market or industry to ensure the vendor is viable.

Have strong knowledge of local conditions and regulations, which can result in superior support.

Have a deeper understanding of local or business-specific applications with which the ECM solution must integrate. This expertise can result in a faster, more-effective implementation and reduce risk.

Speak their clients' local language, enabling their development teams to more quickly and efficiently work with customers to create complex customizations or meet other specialized requirements.

Have cloud data centers within a single European country's borders, which makes it easier for them to comply with local or national data protection and privacy legislation.

Recommendations:

Research all relevant national regulations and standards that your ECM solution must address in your markets

Work with ECM vendors to ascertain whether adherence to equivalent U.S. or international standards is sufficient, or if additional regionalized compliance is required.

Require vendors to demonstrate, if needed, how they will support regionalized standards, data storage and regulatory compliance.

Notable Vendors

Vendors included in this Magic Quadrant Perspective have customers that are successfully using their products and services. Selections are based on analyst opinion and references that validate IT provider claims; however, this is not an exhaustive list or analysis of vendors in this market. Use this perspective as a resource for evaluations, but explore the market further to gauge the ability of each vendor to address your unique business problems and technical concerns. Consider this research as part of your due diligence and in conjunction with discussions with Gartner analysts and other resources.

Alfresco is a vendor of open-source ECM products with headquarters in the U.K. and U.S. It sells worldwide, but has a particularly strong presence in France, Germany, Italy, Spain and the U.K. Alfresco concentrates on the financial services, national government and healthcare sectors, in which it competes both directly and via partners. Its strength lies in the open source nature of the platform (of particular importance in the U.K. public sector) and its many different connectors.

The majority of Everteam's users are based in Europe. It covers a wide variety of on-premises use cases. A cloud version of its software can run in any cloud provider that the client chooses, allowing for flexibility for those EU nations with strict policies about data storage locations.

Fabasoft, which is headquartered in Austria, offers on-premises and cloud-based ECM and business process management (BPM) solutions, as well as a private cloud ECM solution delivered as an appliance. The products are ECSA V3.0 and MoReq2 certified. Its strongest focus is on case management for local and national government, and regulated industries including financial and pharmaceutical businesses. It also offers the Mindbreeze enterprise search and content classification product as a boxed, turnkey solution. Fabasoft offers browser-based user interface for end users as well as administrators, mobile support, integrated ECM and BPM modules, and custom case management applications and business processes.

M-Files is a Finnish vendor that has had strong growth across Europe over the last year. The vendor offers its ECM product in on-premises and cloud versions, with strong integration between the two environments. It can support very granular hybrid deployments. Its use of metadata for all aspects of its infrastructure, from security to navigation, gives it a lot of deployment flexibility. M-Files pursues localized certifications in many European countries.

SER Group headquarters is in Germany with international subsidiaries throughout Europe, and is used predominantly for records management, compliance and process applications. Solutions are available installed with Doxis4 iECM suite, or as a cloud service with Doxis4 Cloud. SER Group is a strong partner for European organizations. Doxis4 Cloud is partially managed in Portugal and runs fully on Amazon EC2, but can be hosted in other jurisdictions according to customers' needs. SER Group meets many country specific standards found in European nations.

Siav has good coverage and expertise in many southern European countries. Based in Italy, it focuses on digital mailroom, case management, capture solutions and also workflow and invoice management with ERP integration, as well as document portals. It also offers a solution for collaboration, as well as file synchronization and sharing, called BlueDrive. Siav is very strong in government and provides ECM solutions to Italian government organizations and other multinational organizations headquartered in Italy. It has a relatively small number of clients outside its core market, but continues to show up on shortlists for regional use cases.

Das wars dann für den ECM Enterprise Content Management Magic Quadrant - mehr gibt es auf unserem Update 2017!

Herausforderungen zu EIM Enterprise Information Management

Auch zum Thema EIM Enterprise Information Management gibt es Neues von Gartner - anderer Bereich als die Kollegen von ECM und BPM. Hier zeichnen Andrew White, Doug Laney and Michael Moran im Oktober 2016 für drei Toolkits verantwortlich:

Information Management Maturity — Critical Challenges, Real Remedies

Dazu gehören

Leider alle drei nicht kostenfrei. Informationen zum PROJECT CONSULT EIM Enterprise Information Management Maturity Model (von 2013) gibt es hier in diesem Folienset: http://bit.ly/EIMmaturity

Also greifen wir einmal auf eine andere Gartner Ressource zurück und zeigen zumindest Mal die Grundlage des Enterprise Information Management Maturity Model:

Trends bei BPM Business Process Management

In unserem obigen Beitrag sind wir auf die Gartner Magic Quadrant Reports 2016 zu WCM Web Content Management und ECM Enterprise Content Management eingegangen. Natürlich gibt es auch zu anderen Branchen-Teilbereichen Untersuchungen - so z.B. zu BPM Business Process Management. Bei PROJECT CONSULT sind wir allerdings der Meinung, dass BPM Business Process Management eine wesentliche Komponente von ECM ist und bleibt. Ohne Prozessunterstützung geht bei ECM garnichts. Werfen wir einen Blick darauf, wie Forrester und Gartner diesen Markt sehen.

Gartner 2016

Magic Quadrant for Intelligent Business Process Management Suites

Der MQ von Rob Dunie, W. Roy Schulte, Marc Kerremans und Michele Cantara vom August 2016 bemüht erst einmal eine aufwändige Definition, was diesen BPMS-Markt ausmacht. Es geht gleich um Suiten und intelligent sollen sie auch noch sein.

Gartner: "Intelligent business process management suites provide real-time insights to achieve better business outcomes and help business transformation leaders, business process directors and solution architects improve business outcomes through process reinvention and transformation.

The intelligent business process management suite (iBPMS) market is the natural evolution of the earlier BPMS market, adding more capabilities for greater intelligence within business processes. Capabilities such as validation (process simulation, including "what if") and verification (logical compliance), optimization, and the ability to gain insight into process performance have been included in many BPMS offerings for several years. iBPMSs have added enhanced support for human collaboration such as integration with social media, mobile-enabled process tasks, streaming analytics and real-time decision management. For a more detailed description of business process management (BPM) platforms, see "Select the Right Type of BPM Platform to Achieve Your Application Development, Business Transformation or Digital Business Goals." For a more detailed description of technologies that help make processes more intelligent, see "Practical Ways to Make Business Operations More Intelligent." An iBPMS orchestrates work to produce business outcomes that go far beyond typical process efficiency and performance measures. For Gartner's 2016 iBPMS Magic Quadrant, we evaluated platforms based on their ability to orchestrate increasingly complex work styles. 1 We see this ability to address a wider variety of styles as increasingly important, particularly in the context of digitalized processes (processes that coordinate the behaviors of people, processes and "things"/the Internet of Things [IoT]) — which require greater insight into context, are executed at an increasingly rapid pace, and span the virtual and physical worlds for both contextual insight and work execution. Greater contextual insight manifests itself at two levels:

(1) At the macro level, using on-demand analytics, such as critical path and workload volume analysis, to drive improvements in the process design, which is often useful in continuous process improvement and business transformation efforts

(2) At the micro level, using real-time analytics and decisioning (such as business rules and complex-event processing [CEP]) to drive improvements in the execution of a particular process instance, which is useful in ways that go beyond traditional business transformation to the execution of digitalized processes."

Die drei Platzhirsche mit größren Abständen untereinander sind wie so häufig Appian, IBM und Pegasystems. Bei PROJECT CONSULT mögen wir Bizagi, denn da gibt es eine freies Design-Werkzeug im Web für BPMN 2.0. Interessant auch, dass sich die Software AG von unten herankämpft.

Magic Quadrant for BPM-Platform-Based Case Management

In dem MQ von Rob Dunie and Janelle B. Hill vom Oktober 2016 geht es um eine "Abart" von Business Process Management: Case Management. In Deutschland würden wir sagen "Vorgangsbearbeitung" oder "Fall-bezogene Sachbearbeitung". In den USA meint man das Thema "Elektronische Akte und Vorgänge" halt neu zu klassifizieren. Letztlich ist die Erkenntnis, dass es sich auch bei Case Management um eine Art Workflow, äh, Business Process Management, handelt.

Gartner: "BPM-platform-based case management frameworks are configurable "apps" meant to help solution architects accelerate the delivery of unique and flexible case management solutions.

Case management frameworks (CMFs) are commercial 1 software offerings designed to reduce the time and complexity of creating case-style process solutions by providing architectural patterns and at least some business domain capabilities "out of the box." Work is caselike when each work item — each case — requires unique handling, involving complex interactions between content, people, transactions and business or regulatory policies in order to deliver an optimal outcome. 2 Case-style processes do not progress in a serial or completely predictable fashion. 3 Rather, they often require multiple dependent workflows to be orchestrated, making them particularly complex to architect. Very often, caseworkers need the flexibility to decide the best next action for a case, rather than following a prescribed workflow.

The "case" metaphor for work handing is being embraced in many new industries and business domains. New "casework" is more decision-intensive, rather than content-centric. These shifting requirements have caused many buyers to look beyond past approaches — such as enterprise content management (ECM) systems' document workflow — and have triggered case handling as a growing use case for business process management (BPM) platforms. CMFs reflected in this evaluation represent a segment of the broader BPM platform market."

Das Feld beschreibt diejenigen Anbieter, die noch mit eigenen Produkten unterwegs sind (längst ist bei vielen anderen das Thema BPM in andere Standardsoftware integriert. Oben rechts wie meistens Appian, IBM und Pegasystems.

Critical Capabilities of BPM Platform-Based Case Management Frameworks

Ein weiterer Report vom November gibt dann noch Informationen zu "Performance" der wichtigsten Anbieter.

Forrester 2015/2016

Bei Forrester müssen wir zum Vergleich aktuell noch auf die entsprechenden Reports aus dem Jahr 2015 bzw. Februar 2016 zurückgreifen. Forrster hat einen anderen Veröffentlichungsrythmus als Gartner - und natürlich auch andere Kriterien.

The Forrester Wave™: BPM Platforms For Digital Business, Q4 2015

Die Forrester Wave zu BPM wurde vor ziemlich genau einem Jahr im Niovember 2015 von Clay Richardsen verfaßt. Wesentlich wird die Reduktion der Komplexität herausgestellt. Schwerpunkt ist die Integration in oder die Erstellung von Geschäftsanwendungen mit BPM-Werkzeugen.

Forrester: "Appian, IBM, And Pegasystems Lead The Pack. Forrester’s research uncovered a market in which Pegasystems, Appian, and IBM continue to lead the pack. Software AG, Oracle, Newgen Software, OpenText, Bizagi, K2, and DST Systems offer competitive options. Red Hat and TIBCO Software lag behind.

The BPM Platforms Market Is Growing As EA Pros Accelerate Digital Transformation. The BPM platforms market is growing because more EA professionals see BPM as a way to address emerging challenges for customer experience and digital business. This market growth is, in large part, because EA pros increasingly trust BPM platform providers to act as strategic partners, helping them transform how they use technology to win, serve, and retain customers in the digital age.

Differentiators Include Rapid Development, UX Design, And Case Management. As legacy BPM technology becomes outdated and less effective, improved delivery speed and process flexibility will dictate which providers will lead the pack. Vendors that can provide fast ramp-up, flexible mobile experiences, and dynamic case management position themselves successfully to deliver speed and business agility to their customers."

Auch hier die üblichen drei "Verdächtigen" Appian, IBM und Pegasystems vorn.

The Forrester Wave™: Dynamic Case Management, Q1 2016

Und natürlich gibt es analog zu Gartner auch bei Forrester eine Wave zum Case Management. Diese stammt von Craig Le Clair aus dem Februar 2016.

Forrester: "Pegasystems, Appian, And IBM Lead The Pack. Forrester’s research uncovered a market in which Pegasystems, Appian, and IBM lead the pack. Lexmark Enterprise Software, TIBCO Software, OnBase by Hyland, Isis Papyrus, Newgen, Software, OpenText, Eccentex, and DST Systems offer competitive options. Bpm’online, MicroPact, and Column Technologies lag behind.

EA Pros Are Looking For Case Platforms To Support Knowledge Workers. The nature of work is transitioning from a production- and task-driven orientation to a knowledge- and context-driven one. The DCM market will continue to grow as more EA professionals see DCM as a way to address their top challenges.

Analytics, Information-Led Design, And Runtime Evolution Are Key Differentiators. As workflow and business process management (BPM) become outdated and increasingly ineffective for less-structured work patterns, providers that offer improved analytics and information modeling will emerge as leaders."

"Langweilig" - schon wieder die Gleichen. Oder liegen alle Analysten mit Ihrer Einschätzung richtig?